Streaming and vinyl sales lead Australian music market’s sixth year of growth [report]

![Streaming and vinyl sales lead Australian music market’s sixth year of growth [report]](https://images-r2.thebrag.com/tmn/uploads/vinyl-sales-up-after-record-store-day-bowie-reigns.jpg)

The Australian recorded music market experienced its sixth consecutive year of growth in 2020, according to new wholesale figures released by the Australian Recording Industry Association (ARIA).

Despite the expansion of the market during the pandemic, the numbers indicate challenges that need to be addressed with even greater urgency this year.

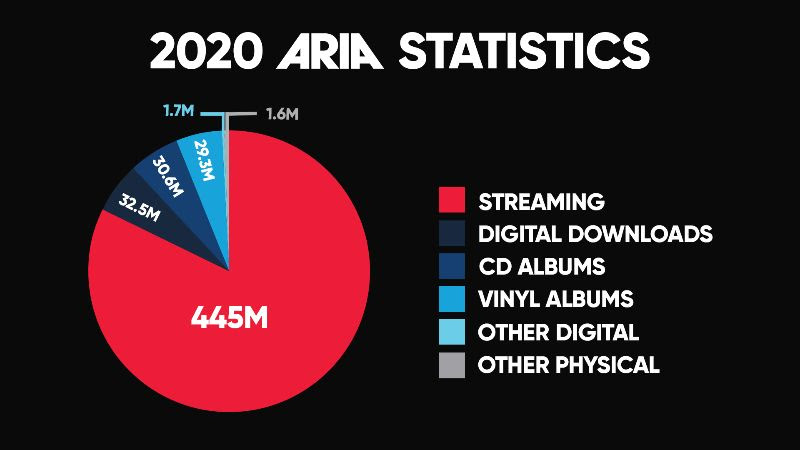

The market widened by 7.3% to $542 million, mostly driven by greater consumption of music streaming and a greater demand for vinyl. The market was divided into $480.2 million digital sales (no unit sales were provided by ARIA) while the physical market (CDs and vinyl) contributed $61.7 million from sales of 4.52 million units.

ARIA noted that digital sales were once again down, decreasing 27% year on year (YoY) to 6.0% of the total market in 2020. Digital singles still made more money than digital albums – $17.8 million compared to $14.7 million. In 2019, digital singles were making $24.4 million (a drop of 26.8% in 2020) and digital albums $20.7 million (down 28.9% in 2020).

This 7.3% growth in Australian music revenue is in line with the 7.4% global growth announced last month by IFPI. Compared to other countries, Australia is on par with North America (7.4% growth) and beats Europe (3.5%), but lags behind South America (15.9%), Asia without Japan (9.5%), and Africa and the Middle East (8.4%).

ARIA reports that streaming services saw a rise of 14% YoY and made up 82.3% of the total market in 2020 across all services, including subscriptions, ad-supported models and video services.

The good news for the industry is that while more Australian consumers are turning to music streaming (reaching 12.7 million in 2020 or 61% of the population according to Roy Morgan Research), they are willing to pay for it by embracing subscription services.

This is obvious from the fact that revenue from subscription services was up 14.9% to $362.3 million from $317 million in 2019, and video streaming revenue up 13.46% to $43.4 million, compared to $38.3 million last year.

However, revenue from free, ad-supported streaming models rose a mere 0.75% million, from $39.8 million to $40.1 million.

According to ARIA, streaming growth was down by 30% from 2019, which suggests the long-anticipated plateauing of growth took place last year even though music fans were, for the most part, cooped up in their homes.

Vinyl albums continued their renaissance, with a 32% revenue rise to $29.3 million from 1.14 million sales. In 2019, LP revenue was at $22.2 million with unit sales of 884,946. Vinyl albums now make up 5.4% of the market.

In comparison, CD wholesale figures plunged 17% YoY to 3.92 million units and a value of $30.5 million. They now make up 5.6% of total revenue.

Vinyl is only $1 million behind CD wholesale revenue and is projected to overtake it in 2021. Vinyl singles only generated income of $58,100 (from 8,801 unit sales) compared to $51, 210 from 3,868 units in 2019.

Full figures can be found on ARIA’s website.