The majors are sweating over Spotify’s direct licensing deals, but everyone has forgotten about Tencent

Spotify needs content, and the labels love Spotify. But does Spotify need the labels? Yes and no.

Earlier this year, as Spotify was starting its new life as a public entity, news emerged that the streaming giant had begun signing direct, non-exclusive licensing deals with indie artists and managers.

According to a report published in Billboard, Daniel Ek’s powerhouse digital platform was open for business with management, who could now secure advance pays of tens or hundreds of thousands of dollars for agreeing to directly license a certain number of songs.

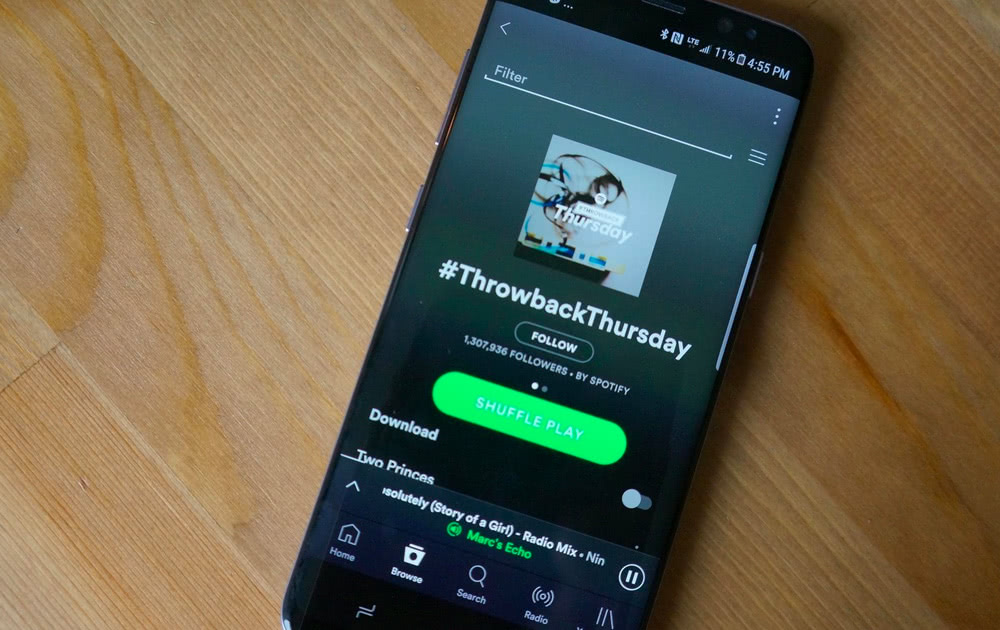

It’s in the DNA of an evolve-or-die tech company to try its hand at a different approach to securing a better deal. And Spotify didn’t get to where it is today – a $33 billion market cap company with more than 170 million monthly active users (83 million-plus paid) – by smiling at the sky and whistling a happy tune.

Spotify’s Daniel Ek

To take this direct path would secure the content and control pipeline and create a much cosier relationship between artists, their team, and the (current) No. 1 streamer. And it most certainly would freak out the major labels, which are experts at marketing and buffing rough gems into shiny diamonds, but typically terrible at the tech and retail end.

Labels are sweating over it. The big record companies see the Spotify initiative “as a potential threat,” wrote the New York Times in recent days, a “small step that, down the line, could reshape the music business as it has existed since the days of the Victrola,” a vintage record player.

Artist managers who spoke with this reporter at Music Matters this week in Singapore confirm as much, and they’re thrilled for the freedom to experiment and hunt down the best options for their wards.

The big labels, after all, made tidy sums when they took turns selling their stakes after Spotify floated through a direct listing. The labels have always done well out of Spotify, with zero risk.

According to the Times report, the majors could try the tough-guy approach, with some execs quietly hinting that they could find a way to hurt Spotify by withholding the licenses the firm needs to expand to India, or play a new type of hardball with their partner when contracts expire in the months ahead. Put it another way, the knives are being sharped for the goose that laid the platinum egg.

All of this, however, could be a major distraction to the real action

Tencent Music, China’s dominant digital music platform, is gearing up for a public listing in North America for what some observers anticipate will be a $30 billion flotation. Tencent Music has a mind-boggling (non-paying) user base in China, and, as it opens us to international artists and its brand crosses borders, many see the platform as a golden opportunity for creators. Tencent Music has a share swap arrangement with Spotify.

You can be sure Tencent Music will be taking notes on Spotify’s direct licensing arrangements. This genie is out of the bottle; fat chance it’s squeezing back in there. Majors, it’s your call.

This article originally appeared on The Industry Observer, which is now part of The Music Network.