Study: smart speakers, streaming services, help each other’s booming sales

A new US study by market research firm AudienceNet shows that two of the fastest growing sectors in music tech — smart speakers and streaming services – are helping each other grow their already-booming sales.

The data further highlights the way new technology is shaping music consumption, especially with younger age groups.

The study, Audiomonitor 2018: The Overall Music Listening Landscape, surveyed 3,000 people over the age of 16.

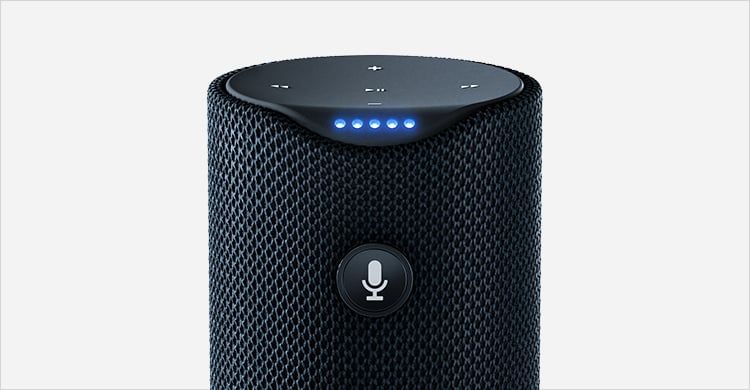

It is already known that in the US, smart speakers as Google Home, Apple HomePod and Amazon‘s Echo leapt by almost 200% in the second quarter of 2018.

Such is the speedway rate, 50% of Americans are forecast to own a smart speaker in 2019, up from the current 14%, and Echo is the most popular.

But what AudienceNet shows is the extent to which streaming and smart speaker ownership are interacting.

43% in the study both own a smart speaker and stream – and 37% of device owners started to subscribe to a streaming service only after they bought a device.

AudienceNet reports: “43% of smart speaker owners also agreed that using their device increased the number of music playlists they listen to, while around 40% discovered more music and 38% listened to a broader range of music than they did previously.”

73% of smart speaker owners say that buying their device “changed the way they listen to music”, with half of them listening to more music and spent longer listening.

Little wonder that there are moves by manufacturers such as Samsung to integrate with the likes of Spotify.

Further AudienceNet figures notes that in terms of total listening time the US, AM/FM radio at 31% beat on-demand service at 27%.

But with the 16—24 age group, radio listening only accounts for 12%.

Listenership to radio and CD players is higher depending on the progressive age of the consumer.

It is highest (45%) with those aged 65 and over, and very low with the 16—24 demo.

The primary listening device for music for younger listeners is the smartphone – 45% for the16-19 group, 40% for the 20-24 group, and 31% for the 25-34 demo.

The smartphone also grew by 6% in the last 12 months to being the single most used device to listen to music, to 25%.

However, when all age groups are factored in, radio receivers of all types (AM/FM radios, in-car AM/FM receivers) accounts for the predominant 30%.

AudienceNet prepared the study for The Music Business Association, a not-for-profit membership organization that promotes and invests in the future of the music business through events, education and engagement.