Merlin: Indies on digital growth trajectory but value-gap widens

Merlin has another trick up its sleeve.

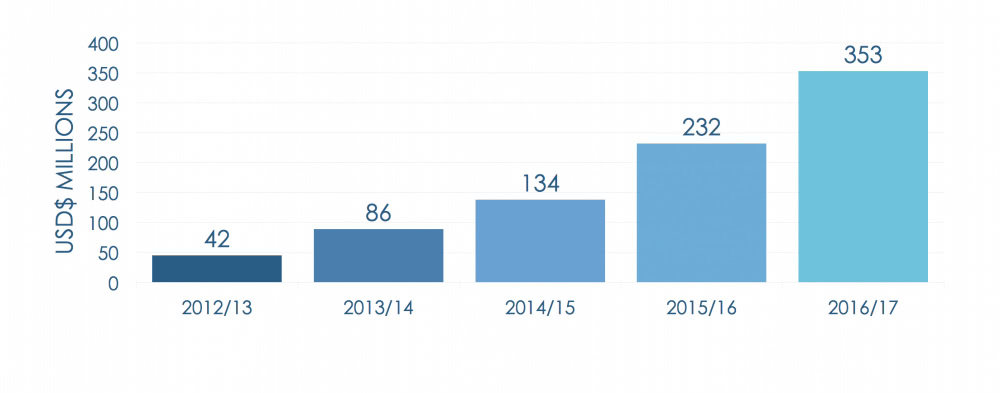

The independents’ digital rights agency revealed annual distributions for its members have topped US$353 million, a 52% year-on-year gain, with demand for audio streaming services leading the way. This headline figure across Merlin 700-strong membership represents an eightfold increase in just four years.

Merlin’s Australian-born CEO Charles Caldas shared the data and other insights at the A2IM General Meeting on Thursday during NYC’s Indie Week.

The news wasn’t all good. On the YouTube “value gap” issue, Caldas reported that audio streaming revenue growth is outstripping video by a ratio of 3:1, based on an analysis of several billion streams over a 12 month period to March 2017. Some 42% of Merlin’s members claims that YouTube and other such services account for less than 5% of their digital revenues, a figure almost unchanged from a year ago. “Merlin was already aware that video streaming services command ten times more users than their audio equivalents yet return less than a tenth of the revenues,” the agency notes, “but this revenue growth differential means the gap is growing starkly.”

After reaching out to its membership, Merlin learned some truths about how music fans are consuming indie music, and how it’s all panning out for its members’ bottom lines. Nearly two-thirds (64%) of its members report that audio streaming generates the lion’s share of their digital revenues, up from about less than half (46%) that said this was the situation a year ago.

And the world away from home is apparently a huge source of digital revenue for many indies. According to data published in its latest member survey, some 42% of Merlin’s members reported that more than half of their digital revenues came from outside their domestic market, while only 17% said the same for physical revenues.

“Over the past 12 months, we have witnessed a great leap forward,” Caldas notes. “Audio streaming is now dominating Merlin members’ digital business, and we are continuing to see the vast majority of our independent labels thrive under what are very different market dynamics.

“As a global-facing agency, it is especially pleasing to see such consistent international growth, and the continuing over-performance of Merlin-licensed repertoire on paid subscription tiers. Clearly, the labels we represent and the artists they support hold a unique value to music fans the world over. The only relative step backwards is the industry-wide underperformance of video-streaming. If we can address this market anomaly, then the uplift across the business would be enormous.”

Merlin’s announcement is much more than a puff piece about the might of the collective indie biz. These numbers give steel to an organization which opened for business a decade ago when four majors ruled the game and digital was a marginal – but promising – sector.

With the go-ahead from the most powerful players in the indie world, Caldas, a former CEO at the once-mighty Shock Entertainment Group, relocated from Melbourne to London in the late noughties and shaped Merlin from scratch.

The London-based association announced itself in January 2007 during the Midem trade fair in Cannes, with a bold statement to empower the indies as the “virtual fifth major.” How things have changed. The music biz now gathers just three majors (four, including Merlin) and Midem convenes in June.

The not-for-profit now represents more than 20,000 indie labels, who collectively account for an estimated 12 percent of the global digital music market. Since opening for business in May 2008, Merlin has licensed such digital services as Spotify (announced in April 2017), SoundCloud, YouTube Red, Pandora, Google Play, Deezer, Vevo and KKBOX.

This article originally appeared on The Industry Observer, which is now part of The Music Network.