Slowed by lockdowns, Australia was ‘lowest performing’ recorded music market in 2021: IFPI

Australia’s recorded music industry posted another year of growth in 2021, but at a miserly rate that was at odds with a booming global market, powered once again by streaming models.

Growth is always good, and Australia’s business is on the good side of ledger.

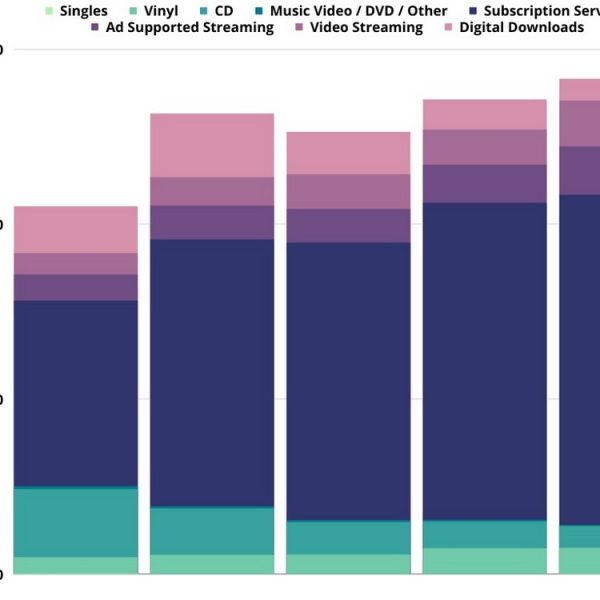

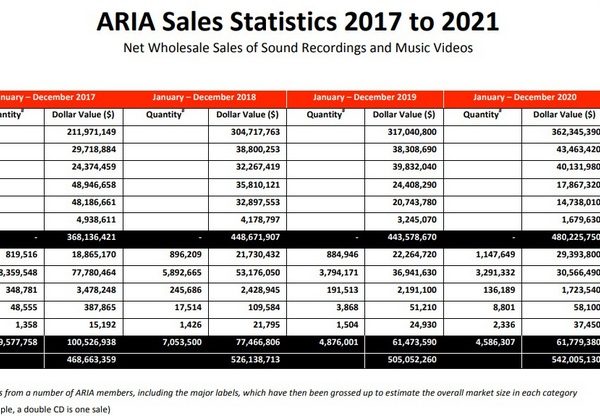

Today (March 23), ARIA posts wholesale revenue of $565.8 million for 2021, up 4.4% from $542 million in 2020, for a 15-year high.

It’s the third successive period of growth for a market whose consumers are committed music streamers, as Spotify, Apple Music and the myriad platforms accounted for 86% of national recorded music revenue across the calendar year.

When measured against other Top 10 markets, Australia was flagging.

Almost certainly, the pandemic, and Australia’s strict response to the health crisis, was the culprit.

Overall, the global recorded music market grew by 18.5% during the reporting period to US$25.9 billion, for a seventh-straight year of growth, fueled again by paid subscription streaming, according to the IFPI.

Australia “was the lowest performing market globally,” notes Frances Moore, who was on hand during a conference call overnight to present the IFPI’s Global Music Report 2022.

The growth was “very much based on streaming” and there was “some growth in vinyl,” she responded to a question from TIO. “We just didn’t see the market lift in the way we saw some of the other markets.”

Moore continued, “some of it has to do with the total lockdowns we saw, and then it took longer for Australia to come out of the lockdowns.”

Lockdowns affected the rate of growth in several ways. With cars parked at home, commuters missed their daily music streaming rituals to and from work. And while stuck at home, music streaming platforms had to compete for attention with on-demand TV services, which include Netflix, Disney+, Amazon Prime, ABC’s iView.

Also, getting to a record store was out of question.

“The fact there was so much lockdown, it really did have an impact,” Simon Robson, President, International, Recorded Music, Warner Music Group, explained on the conference call.

“Obviously that made it harder for people to buy vinyl. We need to look at Australia in two years, because of the situation that happened with COVID.”

Vinyl albums came in slightly ahead at $29.7 million and is now the biggest segment for physical soundcarriers in the Australian market, ARIA reports, taking ground from the eroding market for CD albums, which fell $30.5 million to $24.9 million.

As recently as 2020, CDs were still the boss.

The big boss today is the sector for subscription streaming services revenue, which generated two thirds of total industry wholesale revenue, or $377.3 million, up 4.1% year on year.

Video streaming surged by 26.5% to $55 million, as did ad-supported streaming models, posting 31% gains to $52.6 million.

Annabelle Herd

“Continued, solid growth in digital figures year on year is exciting, even as Australians turned to digital music much earlier than many of our global counterparts,” notes ARIA Chief Executive Officer, Annabelle Herd, in a statement.

“I hope this news spurs on our brilliant home-grown artists as they move toward a more regular year of touring and reconnecting with fans across the country.”

According to the IFPI’s data, Australasia experienced growth of 4.1%, still an “encouraging” sign, notes Robson.

New Zealand outperformed its larger neighbour, reporting growth of 8.2%, the IFPI reports, thanks to a rise in streaming revenues.

On a worldwide basis, the international trade body adds, paid subscription streaming revenues increased by 21.9% US$12.3 billion. By the end of last year, 523 million consumers were logging into paid subscription accounts.

“Every single market that we report on reported growth,” explains Moore. “There’s lots of optimism.”

One region that provides joy for the industry is Asia, which grew by 16.1%. The region’s largest market — and world No. 2 — Japan posted growth of 9.3%, as consumers there make the long-overdue transition to streaming products, while China continues to lift its game.

China is now a billion dollar market and the fastest growing nation in the IFPI’s Top 10.

The IFPI’s hybrid conference call featured a panel in London, gathering Moore, with Dennis Kooker, President, Global Digital Business & U.S. Sales, Sony Music Entertainment; Susan Moultrie, SVP of Artist Initiatives and Business Administration, Sony Music Entertainment; Adam Granite, Executive Vice President, Market Development, Universal Music Group; and Konrad von Löhneysen, Founder and Director, Embassy Of Music.

Moore opened proceedings with a message of support to Ukraine. “We stand by Ukraine, we call for peace and an end to violence,” she stated.

Download the free Global Music Report 2022 – State of the Industry report here.