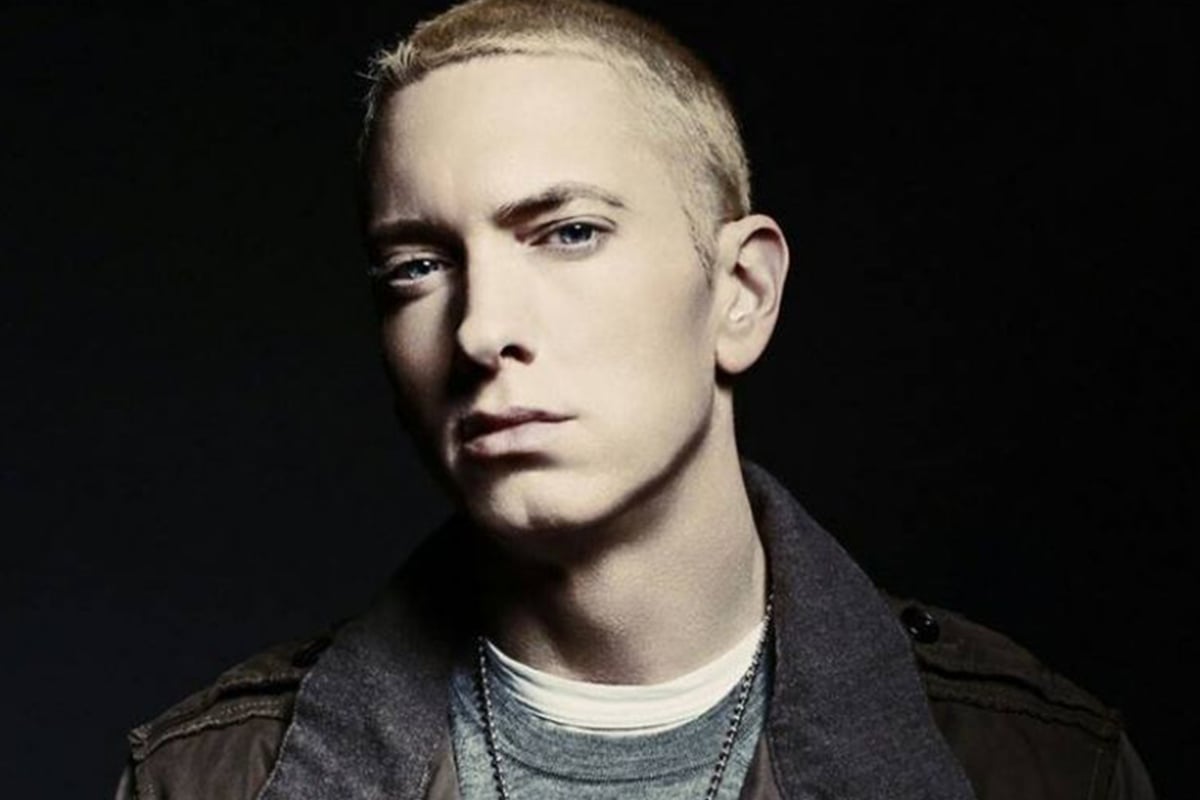

Eminem music to hit stock exchange in deal offered by his producers

Cashed-up Eminem fans will be able to buy shares in the multi-platinum Detroit rapper’s songs in a new unique deal.

His long time producers Mark and Jeff Bass are putting part of their multi-million dollar royalties from the lucrative catalogue on the stock exchange for investors – however, Eminem himself is not involved in the deal.

The Bass Brothers, through their company FBT Productions, have been involved in Eminem’s successful rise to the top.

They signed him up in 1995 after the one time George Clinton producers saw him in rap battles.

They groomed tim for success, and have a substantial cut in every Eminem recording since 1999 when The Slim Shady LP broke him worldwide.

Their cut includes all his collaborations and side projects.

Mark and Jeff Bass produced and co-wrote hits as Without Me, Cleanin’ Out My Closet and the Oscar- and Grammy-winning Lose Yourself from the 8 Mile movie which became the rapper’s first of five US chart toppers.

After 2009’s Relapse, they parted ways amicably as Eminem decided to work with other writers and producers.

But due to the fact they discovered him, they still have a share of royalties for all past, present and future Eminem music sales, downloads, streams and sync appearances in films and ads.

As of July 2017, his album sales have topped 172 million worldwide. Of these, 47.4 million were in the United States.

His biggest seller is The Marshall Mathers LP (2000) with 32 million. It is followed by The Eminem Show (2012) with 27 million and Encore (2014) at 21 million.

Despite no new album in five years, his music continues to sell.

In the first half of 2017, his audio streams were 676.4 million, video streams 481.1 million, song streams 1.124 million and album sales 213, 661. He’s the 14th biggest seller this year.

The new deal calls for the Bass Brothers to sell 25% of their royalty stream to a start-up called Royalty Flow. Last year, this 25% generated $1.3 million, according to Royalty Flow.

But overall, FBT have earned $47.2 million since 2011, or an average of $7.9 million. In some years when Eminem ruled the charts, the figure was $8.7 million in 2012 and $14.5 million in 2014.

Royalty Flow is aiming to raise between $11 million to $50 million through crowd-funding. After that it will list on NASDAQ.

Initially, the smallest investment will be US$2250 for 150 shares, which works out to $15 each.

Jeff Schneider, CEO of Royalty Exchange, says that investing in Eminem’s songs gives a fan greater emotional attachment and pride in the popular artist’s works when they hear it played.

“They can associate it with the fact that they’re earning a little bit when it gets played.”

While Royalty Exchange talks about music as an investment product which yields an annual royalty, it should learn a lesson from David Bowie’s similar venture.

In 1997, he came up with Bowie Bonds offering investors millions of dollars from back catalogue sales for ten years, with a fixed annual return of 7.9%.

He made $55 million from the scheme, ensuring that his record label continued to repackage his old hits from 25 albums released between 1969 and 1990.

But Bowie Bonds ran into problems when the music industry went through a downturn. In 2014, Moodys downgraded them to one level above “junk”.

However the quality of Bowie’s music sustained them. More so, of course, after it started to sell again after his death.

Other artists like Iron Maiden, James Brown and the Motown singing and production team of Holland Dozier Holland also went for similar schemes.

Many analysts say that such music asset-driven schemes will become popular with other artists, as rock music sets poised for another golden era of sales due primarily to streaming.