Warner Music Group stock surges as NASDAQ IPO raises $1.9bn, launches anti-racism fund

Warner Music Group is a public company once again.

After a drawn-out process delayed by the Coronavirus pandemic, the major music company finally made its debut Wednesday (June 3) on the NASDAQ with a $25 price, for an equity valuation of US$12.75 billion.

That’s neatly in line with its projected price of $23 to $26 per share.

Trading under the symbol WMG, the music giant shifted 77 million shares and raised nearly $2 billion for the biggest IPO of the year so far.

As the markets closed, stock was up by 20.5 per cent.

It was a strong debut for a music company which, prior to the streaming revolution, was unthinkable.

The music major filed a registration statement with the U.S. Securities and Exchange Commission back in February, paving the way for a flotation. Thanks to the health crisis and subsequent global lockdown, markets have been bumpy ever since. So WMG sat tight.

Warner Music Group

The health crisis notwithstanding, WMG’s return to the public arena has some merit. And its surge on the stock market will be seen as a signal that the dark clouds which swept in with COVID-19 are starting to disperse.

Streaming is booming, the music industry is resurgent and WMG’s top brass are confident the company is tooled-up for the digital environment.

WMG’s recorded music division generated US$3.84 billion of revenue in fiscal year 2019, with streaming now the largest source of recorded music revenue.

Prior to COVID-19, WMG was in relatively healthy shape.

Through the first three months of 2020, just as the Coronavirus outbreak became a global problem, WMG’s recorded music streaming revenue grew by more than 9 percent to US$586 million.

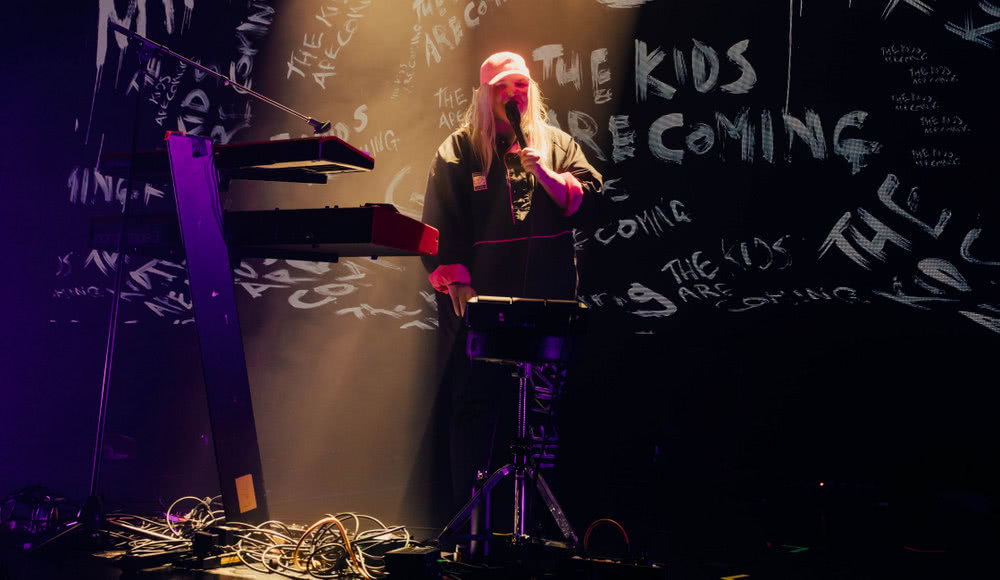

At the time, the company paid thanks to the rivers of gold from streaming, and new releases from Dua Lipa and the continuing success of Tones And I, among others.

Tones And I

WMG’s move comes after Universal Music Group, the global market leader, struck a deal to sell a 10% stake to a consortium led by Tencent, the Chinese tech giant, valuing the music giant at $33 billion.

And Spotify, the leading player in streaming music with more than 270 million users, began trading on the New York stock exchange in a direct listing more than two years ago, raising billions in capital in the process.

After the Joe Rogan podcast deal in recent weeks, its market cap lifted by multiple billions of dollars.

Upon completion of the IPO, WMG has two types of common stock, Class A and Class B, the latter of which is held by Ukrainian-born billionaire Len Blavatnik’s Access Industries and will represent 99.2% of the total combined voting power of our outstanding common stock, Billboard notes.

WMG has been here before. The music giant was a publicly-listed company from 2005 until Access Industries bought it for $3.3 billion in 2011, taking it into private hands once more.

In a busy week for WMG, the music company has also established a $100 million fund to coincide with the music industry’s “Black Out Tuesday” initiative.

The announcement, made after WMG’s flotation, will “support charitable causes related to the music industry, social justice and campaigns against violence and racism.”

Warner Music issued its prospectus in May, which lists the pandemic as a risk factor to its business. Read it here.

This article originally appeared on The Industry Observer, which is now part of The Music Network.