Warner Music Group reveals plans to list on New York Stock Exchange

Warner Music Group wants to go public on the New York Stock Exchange, again.

If the IPO is well received, which is very likely, it will mark the second time in its 62-year history that WMG has publically traded.

The major would join rivals Vivendi Universal and Sony Corporation on the NYSX, with the latter also trading on the Tokyo Stock Exchange.

Formerly part of Time Warner, WMG publicly traded on the NYSX until May 2011, when it announced its privatisation and sale to Len Blavatnik’s Access Industries.

That deal, which was completed in July 2011, was worth US $3.3 billion.

But with the streaming boom well underway, Blavatnik is betting big with a new IPO.

“The shares of common stock to be sold in this offering are proposed to be sold by certain of Warner Music Group’s stockholders,” explained a statement issued on Friday.

The number of common stock shares to be offered, and the price range for the proposed offering, have not yet been determined.

As MBW’s Tim Ingham reasons, MWG’s move to an IPO would – at least in part – be inspired by UMG’s recent $33 billion valuation, after its agreement to sell 10% to a Tencent-led consortium.

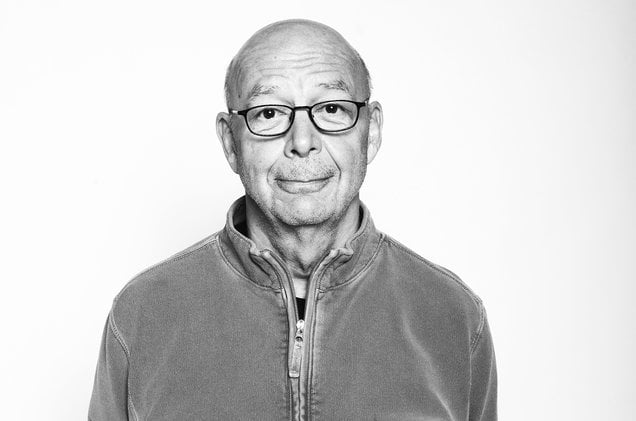

Under chief executive Steve Cooper (pictured, above), the music empire just achieved its best performance of the last 12 months in the final quarter of 2019.

Strong growth in its recorded and publishing divisions generated a turnover of US $1.256 billion.

The highest performing streaming artists in the quarter were Tones And I, Ed Sheeran and Stormzy.

With a multibillion-dollar annual turnover, WMG employs more than 3,500 staffers and offices in about 50 territories.

“We achieved the highest quarterly revenue in our sixteen-year history as a stand-alone company,” said company CEO Steve Cooper.

The quarter, which ended on December 31 and marked the major’s fiscal Q1, represented a 4% rise from the same quarter 12 months before.

“We believe we’ve only just begun to realise Warner Music Group’s true potential as a global music powerhouse.”

The company owns and operates some of the largest and most successful labels in the world, including Elektra Records, Warner Records, Parlophone, and Atlantic Records.

WMG also owns Warner Chappell Music, one of the world’s largest music publishers.

Morgan Stanley, Credit Suisse and Goldman Sachs & Co. LLC are acting as joint book-running managers for the offering, according to the statement.