Streaming is soaring, but growth is slowing: report

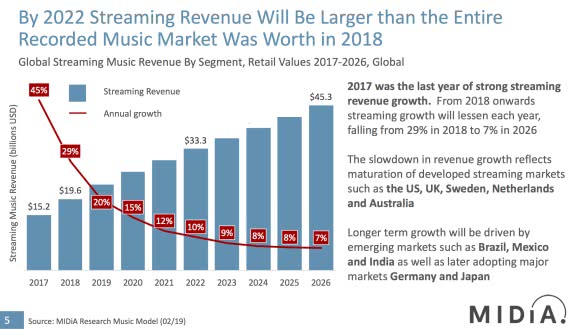

Growth, but less of it. That’s the long-term forecast for the global streaming music sector which, according to a new report published by MIDiA, should more than double in value from US$19.6 billion in 2018 to US$45.3 billion in 2026.

A bit of perspective: by 2022, streaming revenue is projected to be greater than the value of the global recorded music market in 2018.

But behind the headline numbers is a slowdown in streaming revenue growth from those early-adopting markets, including U.S., U.K., Sweden, Netherlands and Australia. Just maybe, we’ve already experienced peak streaming. “2017 was the last year of strong streaming revenue growth,” the report reads.

According to the data, streaming growth should lessen in the years ahead, dipping from 29% in 2018 to 7% in 2026, though expect a kick from Germany and Japan and from emerging markets such as Brazil, Mexico and India, which has just welcomed two of the biggest brands in the business, Spotify and YouTube Music.

MIDiA forecasts

Regardless of the slowdown, it’s a positive picture for an industry which survived the bloody downturn of the noughts and is now very much thriving thanks to on-demand platforms.

MIDiA’s veteran analyst Mark Mulligan pulls out some fun facts in the report. At the end of last year, there were 278 million paid subscribers worldwide, he writes, though, due to the impact of family plan accounts, unique subscriptions were pegged at 242 million.

The U.S. and U.K. were the biggest streaming markets last year and will remain so in 2026, while Germany and France, traditional top-5 recorded music markets according to the IFPI, will continue to flex their streaming muscles.

The game is changing. By 2026, Brazil, India, MENA and China will all be established as top 15 global markets, with the first four each more than doubling revenue compared to 2018, according to the report.

And finally, with Warner Music and Spotify trading blows ahead of the streaming giant’s launch in India, expect tech companies and their content providers to lock horns over money for years to come. The difference between trade revenues and retail revenues will widen between now and 2026, writes Mulligan.

Streaming services should improve their margins and widen the gap on label revenues, due to a range of factors, including rising publishing related rates and potential long-term future label rate cuts.

The next round of licensing talks will see streaming services wield more power. Spotify currently “poses a lot of threat in rightsholder eyes, but its actual power is more limited,” Mulligan continues.

“Streaming revenues accounted for 51% of label revenues in 2018 and with Spotify accounting for less than half of that, this means that Spotify accounts for less than a quarter of total label revenues. The labels, publishers and right bodies need to maximise their negotiating power now, while they can.”

The conclusion is clear, he writes. “Label trade revenues are becoming a progressively less useful way of measuring the future size of the streaming market.”

Read more here.

This article originally appeared on The Industry Observer, which is now part of The Music Network.