Sony Music is now the world’s fastest-growing major label [report]

![Sony Music is now the world’s fastest-growing major label [report]](https://images.thebrag.com/cdn-cgi/image/fit=cover,width=1200,height=800,format=auto/https://images-r2-1.thebrag.com/tmn/uploads/sony-music-uk-hq-london-1-700x467.jpg)

The global recorded music sector is on the up and Sony Music is leading the charge.

That’s according to a new report by research firm Midia.

Midia said Universal Music Group was again the biggest record label last year. But its rival Sony Music is “growing significantly faster than the total market”, making it the fastest-growing major.

Some big hitters last year helped to fuel that growth, including one of our own.

Adele, Doja Cat and The Kid LAROI were cited by Sony Music as major factors behind its 12% year-on-year revenue hike in Q4 2021.

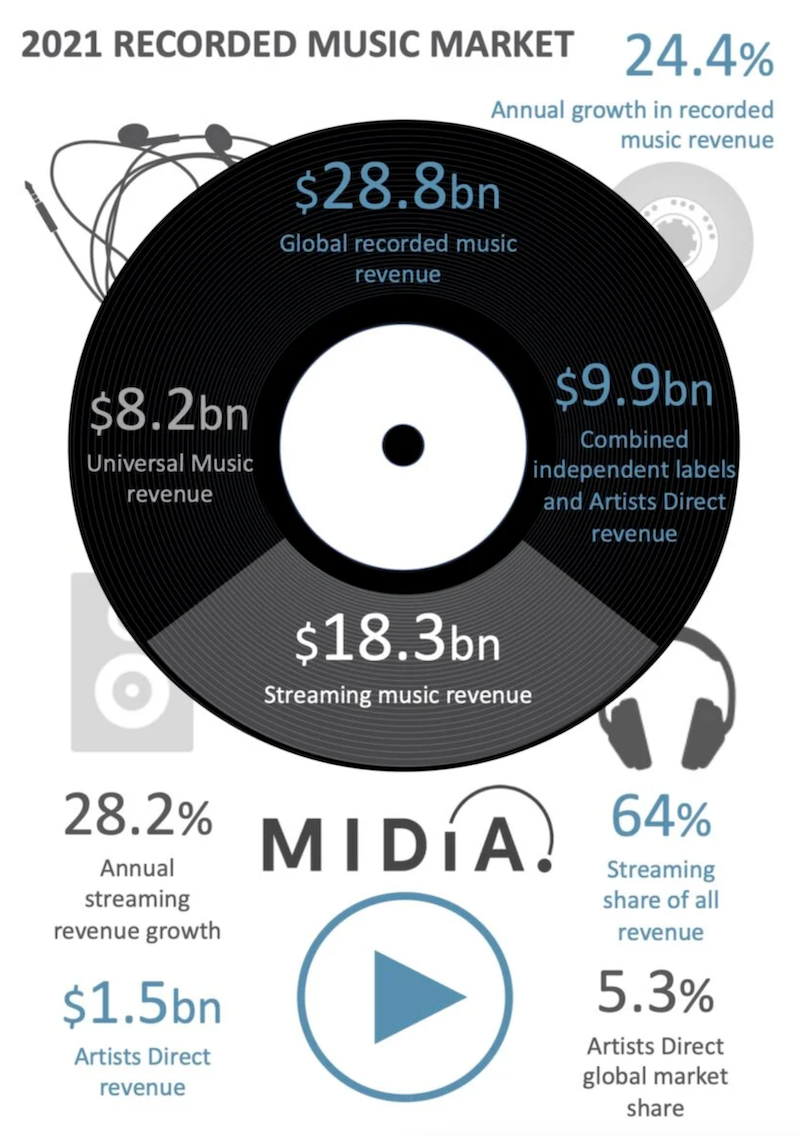

The worldwide recorded music market rocketed into stellar growth in 2021 – rebounding after a shabby 2020, thanks to the pandemic – growing by an estimated 24.7% to reach US$28.8 billion.

It marked a healthy jump from 2020’s more modest increase of 7% – and the highest annual growth rate in modern times, cementing 2021 as “the fastest-growing year in living memory”.

In the new report, which arrived Friday and ahead of the IFPI’s Global Music Report, worldwide streaming revenues are estimated to be up by 29.3% to US$18.5 billion.

Midia’s Mark Mulligan said the recorded music market looked vulnerable in 2020, relying entirely on streaming for growth from the DSPs. But that changed last year.

“2021 was a very different story, with growth on most fronts, but, most importantly, the rise of non-DSP revenue, reflecting an increasingly diversified future in which labels can fret a little less about the prospect of slowing subscriber growth in mature markets,” he said.

“When coupled with longer-term growth opportunities (NFTs, the metaverse, etc), the outlook is positively rosy,” Mulligan added.

The sudden surge in streaming revenues comes not from the major DSPs like Apple, Spotify and YouTube, but non-DSP revenue sources including Meta, TikTok, Snap and Twitch.

Income from these son-DSPs experienced a “massive uplift” to US$1.5 billion.

As predicted, 2021 was also a red-letter year for the independent sector.

Self-releasing acts were “the big winners” last year, driving US$1.5 billion of revenue and increasing market share to 5.3%. These acts also added more revenue than in the prior year – something the segment has done every year since 2015, according to Midia.