iHeartMedia’s future in doubt following submission to SEC

America’s biggest radio network, which launched locally through a partnership with ARN in 2013, may collapse before the year is out.

According to an 8K submission to the SEC (Securities and Exchange Commssion) on Thursday April 20, its debt has lead to “substantial doubt as to our ability to continue.”

The filing, obtained by MBW which broke the story, includes the line:

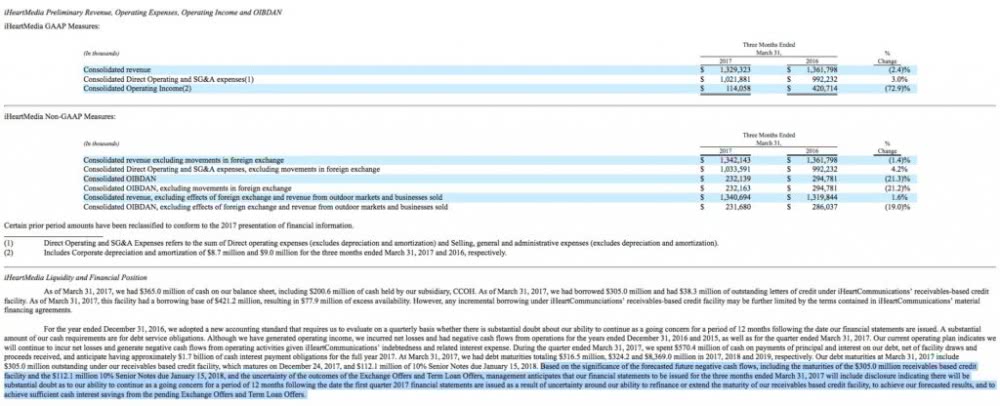

“[…] management anticipates that our financial statements to be issued for the three months ended March 31, 2017 will include disclosure indicating there will be substantial doubt as to our ability to continue as a going concern for a period of 12 months following the date the first quarter 2017 financial statements are issued as a result of uncertainty around our ability to refinance or extend the maturity of our receivables based credit facility, to achieve our forecasted results, and to achieve sufficient cash interest savings from the pending Exchange Offers and Term Loan Offers.”

According to MBW, iHeartMedia is carrying a debt of around US$20 billion. Much of this is care of its buy-out previous parent company Clear Channel Communications Inc in 2008.

The SEC filing notes iHeartMedia’s consolidated revenue for the three months ending March 31 was US$1.33 billion, with a consolidated operating income of US$114.1 million. However, around US$350 million of its debt is due this year, and a further US$8.3 billion is due in 2019.

Further compounding the issue is an article by corporate restructuring reporter Jessica DiNapoli for Reuters. The article notes a group of iHeartMedia Inc’s lenders have signed a cooperation agreement to oppose the company’s push to restructure its debt.

MBW believes that should lenders force iHeartMedia to significantly change its loan swap offer it could result in the company filing for Chapter 11 bankruptcy this year.

This article originally appeared on The Industry Observer, which is now part of The Music Network.