Global record biz posts strong results for 2019: IFPI

The pre-COVID-19 record biz was a picture of health, new data reveals.

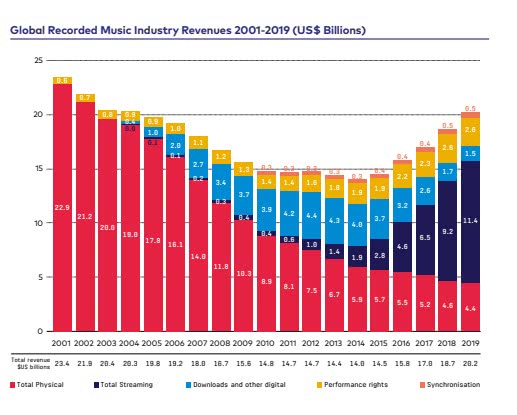

The global recorded music industry powered to a fifth successive year of growth in 2019, according to the IFPI, with streaming platforms providing all the rocket fuel.

For the full year, global recorded music market grew to a value of US$20.2 billion (A$31.3 billion), up by 8.2 per cent, with the likes of Spotify, YouTube Music, Apple Music and the myriad on-demand brands accounting for more than half the sum.

Revenue from streaming came in at US$11.4 billion ($17.6 billion), up by nearly 23 per cent on the previous year, and more than filled the void left the CD format’s disappearing act (a 5.3 per cent decline in revenue).

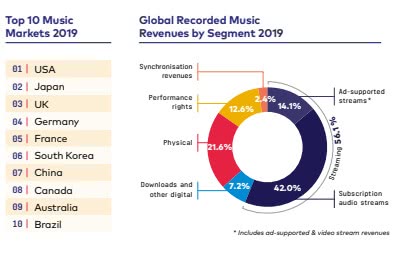

Streaming accounted for more than half (56.1%) of all music revenue, a first in the history of the record business. Though, as many analysts predicted, the growth is slowing as streaming becomes standard in hundreds of millions of homes around the globe.

Over recent years, streaming has accelerated by 60.4% (2016), 41.4% (2017), 34% (2018) and now 22.9%, an excellent rate of growth by anyone’s measuring stick.

In 2019, the IFPI tallied 341 million users of paid streaming services worldwide, up 34% on the previous year.

The numbers are posted in the IFPI’s annual Global Music Report, which dropped overnight.

In it, the trade body notes Australasia had a solid year, with the region boasting overall digital revenues growth of 11.6 per cent as physical format revenues shrank by 20.4 per cent.

Australia, the No. 9-ranked music market, just ahead of Brazil, was up by 6.0 per cent in value, according to the IFPI, a slight gain on the 5.5 per cent reported by ARIA in its full-year report, published in April. New Zealand posted an increase of 13.7 per cent, for a 7.1 per cent lift across Australasia.

Paid streaming revenues were up 20.9 per cent and 30.1 per cent, respectively, performance rights revenue rose by 11.2 per cent across the region and while sync revenues dipped by 3.8 per cent.

And the biggest winner for 2019? That would be Latin America, which grew by 18.9 percent in value. with its three largest markets — Brazil (+13.1 per cent); Mexico (+17.1 per cent) and Argentina (+40.9 per cent) — blasting ahead. It’s the fifth consecutive year of growth for the region.

Europe, the world’s second-largest region, grew by 7.2 per cent, after a mostly-flat 2018. Powerhouse music markets the U.K. (+7.2 per cent), Germany (+5.1 per cent), Italy (+8.2 per cent) and Spain (+16.3 per cent) all turned in good results.

The U.S., the world’s top ranked music market, grew by 10.5 per cent, its fifth successive year of growth as the North America region grew by 10.4 per cent.

IFPI’s Global Music Report is out now – read the definitive guide to the recorded music market in 2019 https://t.co/FqRzfAo9yg #GlobalMusicReport pic.twitter.com/JjpytA4uf9

— IFPI (@IFPI_org) May 4, 2020

Asia’s 3.4 per cent growth came at a slower rate than 2018, a result that can be attributed to one territory: Japan. The world’s No. 2 music market was down by almost one percentage point as consumers make the long overdue switch from CDs to streaming services.

South Korea made the change years ago and the country is reaping the benefits. Last year, the market posted growth of 8.2 per cent in 2019, while the “sleeping giants” that are China and India continue to turn “promise” into something more tangible, with gains of 16.0% and 18.7%, respectively.

All of the numbers, of course, reflect the music world prior to the Coronavirus pandemic. No one is expecting 2020 to be such a bountiful year.

The COVID-19 pandemic “presents challenges unimaginable just months ago,” comments Frances Moore, chief executive of IFPI. “In the face of a global tragedy, the music community has united behind efforts to support those affected.

IFPI CEO Frances Moore presenting Billie Eilish with the IFPI award for biggest global single of 2019

“This is a critical and ongoing priority as our member record companies work to continue to support the careers of artists, musicians and employees around the world.”

The IFPI’s Global Music Report was scheduled to be published in March, but was postponed due to the novel coronavirus.

The report features case studies on Billie Eilish, Rosalia and Tia Ray, and features homegrown artists Jessica Mauboy, Amy Shark, Guy Sebastian and Tones And I, whose hit ‘Dance Monkey’ came in at No. 6 on the IFPI’s Global Top 10 Digital Singles of 2019 chart.

“It has been heartening to see how music has helped once again to unite, inspire and heal,” explains Moore in her opening messages. “We see that music’s timeless power, like the resilient strength of humanity itself, is a light even through difficult times.”

Download the report here.

This article originally appeared on The Industry Observer, which is now part of The Music Network.