Billboard’s chart changes will see paid streams count way more than ad-supported plays

Billboard has tweaked the methodology for how streams count towards its flagship albums and singles charts.

The new rule book is pretty dense, but essentially the weekly tallies will reward streams from paid subscriptions more than those from ad-supported services or programmed platforms.

From the first week of data compiler Nielsen’s third quarter, plays from paid subscription-based services (such as Spotify, Amazon Music and Apple Music) will have a greater weight in chart calculations than streams from “free” (ad-supported) or the free tiers of hybrid paid/ad-supported platforms (think Spotify and SoundCloud).

The main singles chart, the Billboard Hot 100, and the music trade title’s other genre-specific song charts, already gives a greater weight to streams from on-demand platforms (likes Spotify and YouTube) than those from programmed platforms (Pandora). The Billboard 200 albums chart and its various genre-based consumption-ranked albums charts uses a single tier for on-demand audio streams from subscription services (paid or ad-supported).

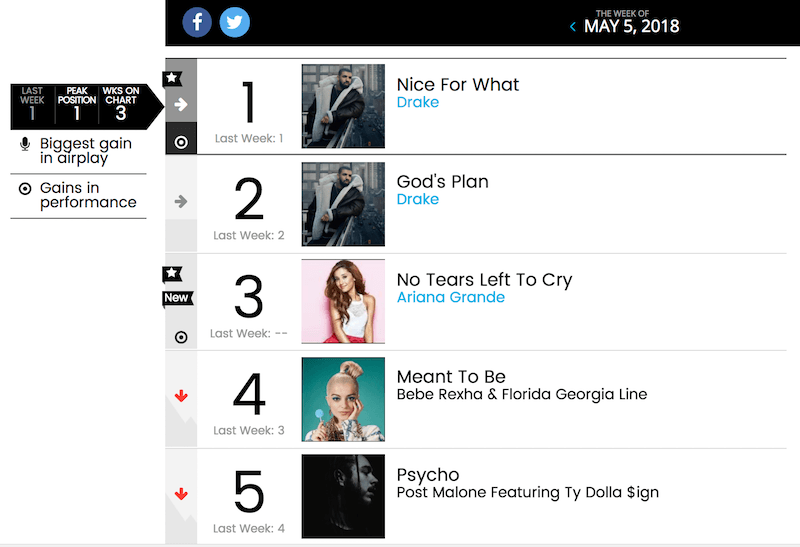

Billboard Hot 100, May 5 2018

Deep breath. Those new changes will see multiple weighted tiers of streaming plays for the Hot 100, which take into account paid subscription streams (representing a full point value per play), ad-supported streams (representing a 2/3-point value per play) and programmed streams (representing a 1/2-point value per play), Billboard reports. Those values are then applied to the chart’s formula alongside all-genre radio airplay and digital song sales data.

On the Billboard 200, audio streams will fall into two tiers

The first, paid subscription audio streams (1,250 streams equals 1 album unit) and, second, ad-supported audio streams (3,750 streams to 1 album unit). That’s a three-to-one ratio.

This retooled, multi-level streaming approach follows a months-long phase of testing and industry consultation, the result of which “is reflective of a global push to measure streams in a revenue-reflective and access-based manner,” comments Billboard. “Music is now being consumed on streaming services in more diverse ways, migrating from a pure on-demand experience to a more diverse selection of listening preferences (including playlists and radio) and the various options in which a consumer can access music differs based on their subscription commitment.”

Chart compilers in every territory will no doubt be studying all these changes

Chart compliers will be paying close attention to the changes — which will be reflected in the charts dated July 14 — and mulling if or when would be a good time to adopt similar measures. ARIA began counting on-demand streams toward its albums chart from May 2017, based on the methodology adopted by the U.K.’s Official Chart Company and several European charts. Streams have counted toward the ARIA Singles Chart since November 2014.

Streaming is now the No. 1 source of revenue, generating 38.4% of total revenue, the IFPI reported in its newly-published Global Music Report. More than 176 million paid subscription accounts are active worldwide, the trade body estimates.

There are more chart changes coming to the U.S. charts in 2019, details on which can be read here.

This article originally appeared on The Industry Observer, which is now part of The Music Network.