5 takeaways from the IFPI’s 2019 ‘Global Music Report’

The numbers are in. And they’re good.

The IFPI, the recorded music industry’s international peak body, presented its global full-year trade data late Wednesday in the U.K., with a high-powered industry panel and an overwhelming sense of optimism. And perhaps relief.

These executives, who included Warner Music Group’s CEO, International and Global Commercial Services Stu Bergen; Universal Music EVP market development Adam Granite; Concord Music COO Glen Barros and IFPI CEO Frances Moore, lived through the dark days of the noughts. These here are enlightened times.

TIO tuned into the conference call with reporters from up to 19 countries. Here are 5 takeaways from the latest Global Music Report.

Revenue is up nearly double digits

The industry’s ugly, post-Napster death roll is for the history books. The global recorded music market posted a fourth consecutive year of growth in 2018. And it did so by nearly double digits, as revenue grew by 9.7% to US$19.1 billion, according to the IFPI’s newly published figures.

WMG’s Bergen summed up the results with some historical context:

“These events are a little more pleasurable than the decade plus of decline…there’s a real confidence that’s infiltrating the ranks of our business. We’re approaching with confidence but we can’t afford to be complacent.”

Streaming is the saviour

No surprises for guessing subscription platforms are the engine for growth. Spotify, YouTube Music and the feast of paid subscription services accounted for 37 percent (or about $7 billion) of total recorded music revenue as dollars from subscription and ad supported platforms combined for about $8.93 billion, almost half of all label income.

There’s a “great deal of optimism in the industry. A great excitement,” Moore noted in her opening remarks.

“But it is of course dependent on the appropriate legal and business infrastructure being in place to ensure music is fairly valued and that revenues are returned to rights holders to support the next cycle of development.”

The IFPI insists it will roll up its sleeves and get on with that fight.

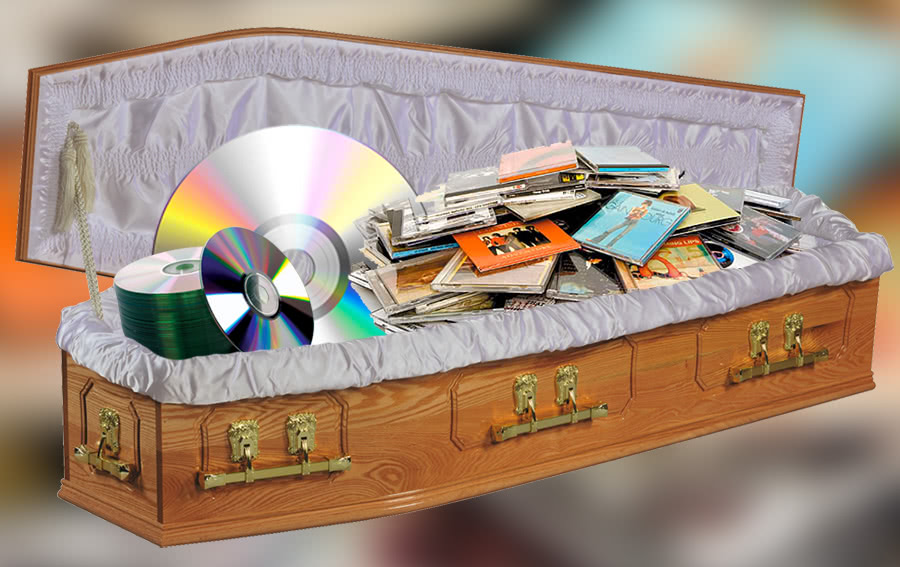

RIP CDs

Physical is finished (it sure looks that way)

There’s always a downside. That’s where CDs come into the picture. Physical soundcarriers shed more than 10% in value, continuing a trend that only a ridiculous optimist could predict would halt.

The future is digital, and the future is here.

Those “high potential” markets are already showing potential

Don’t take your eyes off Latin America. The region flourished for a fourth straight year, generating growth of 16.8% with Brazil (15.4%) and Mexico (14.7%) leading the way.

Asia and Australasia were also impressive (11.7% growth). Asia is now the second largest region for combined physical and digital product.

Australia’s recorded music market will be analysed in full tomorrow. Wholesale figures published last September by ARIA showed total music sales in jumped by 6% to A$195.6 million the first half, fuelled by digital.

Here’s a hot tip: the market grew for the full year, by double digits.

Local repertoire rules, travels

Homegrown music has always been king. Now its crossing borders, thanks to streaming.

“We’re seeing growth in local repertoire everywhere in the world,” noted Granite, citing a J Balvin case study in the report.

“It’s a great time” for opportunities for artists, he enthused “We’re seeing local repertoire thrive.. basically everywhere around the world.” Now is the time, he said, where local repertoire “punches up” and spins on a global stage.

The rise of streaming has created a local opportunity for artists and for markets, like China, which enters the top 10.

“Places that were seriously under-monetised but are now kicking goals,” noted Bergen. “Hits can now come from anywhere in the world.” And they’re not always in English.

Purchase the full data and analysis ‘Global Music Report’ 2019 here. Read the ‘State of the Industry Report’ here.

This article originally appeared on The Industry Observer, which is now part of The Music Network.