Global music streaming revenues dipped in the second quarter [report]

![Global music streaming revenues dipped in the second quarter [report]](https://images-r2.thebrag.com/tmn/uploads/why-not-all-streaming-services-count-towards-the-aria-charts.jpg)

The latest findings from Counterpoint Technology Market Research showed that global music streaming revenue growth declined by 2% in Q2 2020.

Global Online Music Streaming Market Tracker, covering the April to June this year, points out this was the first-ever quarter to show a downtick.

But Counterpoint analyst Abhilash Kumar says the drop is a temporary one.

“The music streaming platforms came up with some discount offers (like free subscription for some months) and also lowered the prices for paid subscriptions to dissuade consumers from leaving the platform or shifting to a free plan.

“Also, the advertisement revenues saw a dip since many companies opted to cut expenditure in view of the COVID-19 pandemic.

“However, podcasts related to different genres were able to keep people glued, offsetting some of the decline.”

From the end of June, music streaming started to rebound, and Counterpoint believes growth will return to pre-COVID-19 levels by Q4 this year.

Overall revenue grew 13% YoY in Q2 2020 at US$6.7 billion (A$9.25 billion) while paid subscriptions grew 29% YoY, compared to 35% YoY in the previous quarter.

In terms of monthly active users (MAUs), Tencent Music (with its subsidiaries QQ Music, Kuwo and Kugou) led the chart in Q2 with a 26% share, helped by its social media and free offerings.

Tencent Holdings’financial report in May showed it had 657 million MAUs and 42.7 million paying subscribers.

Following were Spotify and YouTube Music with 12% and 10% shares, respectively.

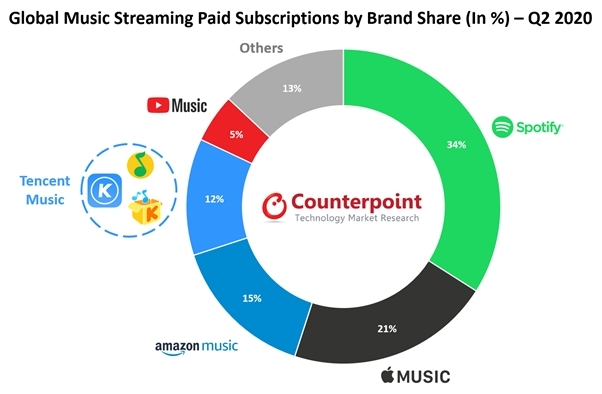

However, in terms of paid subscriptions, Spotify continued to lead with a 34% share, followed by Apple Music with 21% and Amazon Music with 15%.

Kumar attributes Spotify’s continued dominance to “strong brand presence, attractive offerings, presence in more than 90 countries, continuous product improvisation and focus on podcasts” as well as its popular family plan.

In Q3 Spotify entered Russia, and 12 other countries in the region, which gave it an opportunity to tap more than 250 million music fans with a monthly subscription of 69 rubles (the equivalent A$3.31).

India’s largest platform, Gaana, grew 19% QoQ to reach more than 180 million monthly listeners.

While listening hours dropped for the major platforms, they grew for regional brands due to the presence of local content.

Nevertheless, says the report, regional players like Anghami in MENA (Middle East and North East and North Africa), Melon Music in South Korea and Yandex Music in Russia reported almost flat growth QoQ.